Category: Recent News

FROM REGULATOR WATCH – Cochrane Review | Vapes More Effective to Quit Smoking than Gum or Patch

Here’s the latest from Brent Stafford at Regulator Watch:

One of the most hotly contested issues with regard to vaping is whether or not e-cigarettes are an effective tool in the battle to stamp out smoking.

The very mention of this possibility sends regulators, tobacco enforcement agents, and anti-vaping advocates into a tither.In most regions, the vaping industry is prohibited by law from making direct health claims or even suggest that vaping is a viable tool for smoking cessation. Yet, 40-million vapers worldwide attest to their efficacy, and each year more research is published demonstrating what so many already know: Vaping is a highly effective tool to quit smoking.

Joining us today on RegWatch is Dr. Jamie Hartmann-Boyce, from the Cochrane Tobacco Review Group. She is the lead researcher on the Cochrane review of electronic cigarettes for smoking cessation, which released this month and further supports the growing evidence that vaping is an effective tool to quit smoking.

Only on RegWatch by RegulatorWatch.com

Released: October 24, 2020

Produced by Brent Stafford

Make RegWatch happen, go to: support.regulatorwatch.com

VAPING NEWS: JUUL [Initial Racketeering Charges Rejected]

“Juul Labs Inc. won a ruling that knocked out racketeering claims from a group of hundreds of lawsuits accusing the e-cigarette maker of deliberately targeting teenagers. U.S. District Judge William Orrick in San Francisco on Friday said claims brought by consumers, local governments and school districts under the Racketeer Influenced and Corrupt Practices Act — which could have put Juul on the hook for triple damages — didn’t pass legal muster. But the judge said the plaintiffs can amend their court filings and try to make a RICO case. If government entities and others suing over the e-cigarette marketing tactics aren’t successful in reviving the so-called RICO claims, it will take some pressure off Juul and Altria. The judge refused to throw out claims Juul and Altria officials engaged in a “scheme to defraud” through misleading statements about e-cigarettes’ addiction risk. He’s also letting plaintiffs proceed with allegations that executives “sought to grow the market for nicotine-addicted individuals, particularly youth who did not use traditional tobacco products.””

ARTICLE LINK:

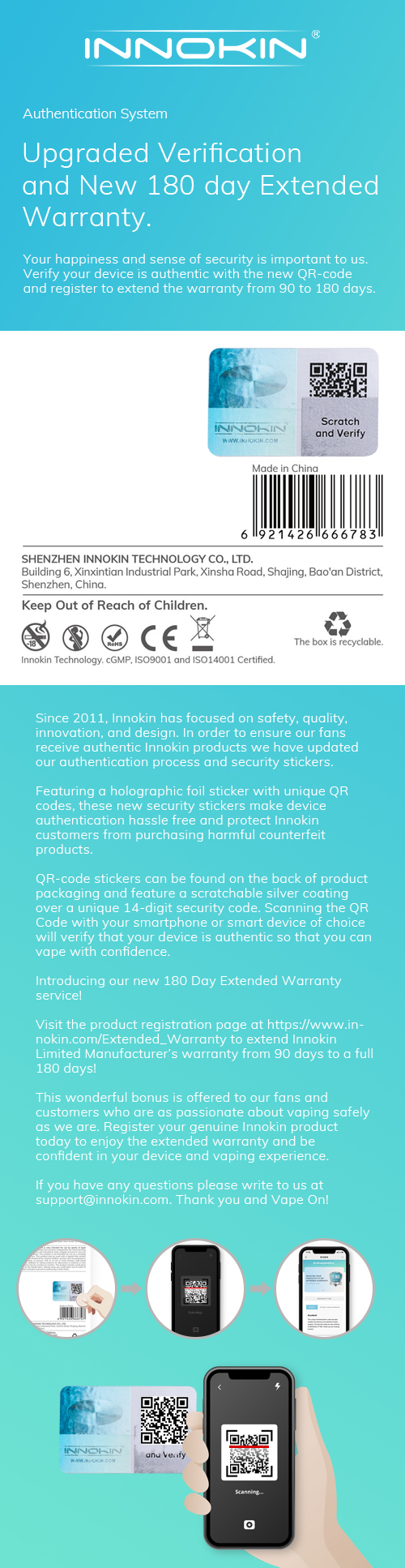

DID YOU KNOW? YOU CAN DOUBLE YOUR INNOKIN WARRANTY TO 180 DAYS!

From Lindsay

Hi Mr. Busardo! I wanted to let you know that I received my Ares II from you late last week and I can’t put it down. Thank you so much! It’s really a wonderful RTA. I’m really blown away—not just by the flavour, but by the entire vape experience it offers. Thank you again. I hope that you and your family are doing well. Take care.

– Lindsay

VAPING NEWS: NEW YORK [State Must Reimburse Vape Attorney Fees]

“A judge has ordered New York state to reimburse a vaping trade group’s attorney fees connected to a lawsuit over the state’s attempt last year to impose an emergency ban on flavored e-cigarettes. Acting state Supreme Court Justice Catherine Cholakis on Wednesday sided with the vaping group that argued state officials overreached their authority and thus should cover the legal costs associated with fighting the ban. Vape shops and the Vapor Technology Association trade group filed the lawsuit and are seeking about $381,000 in attorneys’ fees and costs from the state.”

ARTICLE LINK:

Judge orders NY to reimburse vaping group’s costs for lawsuit on flavored e-cig ban

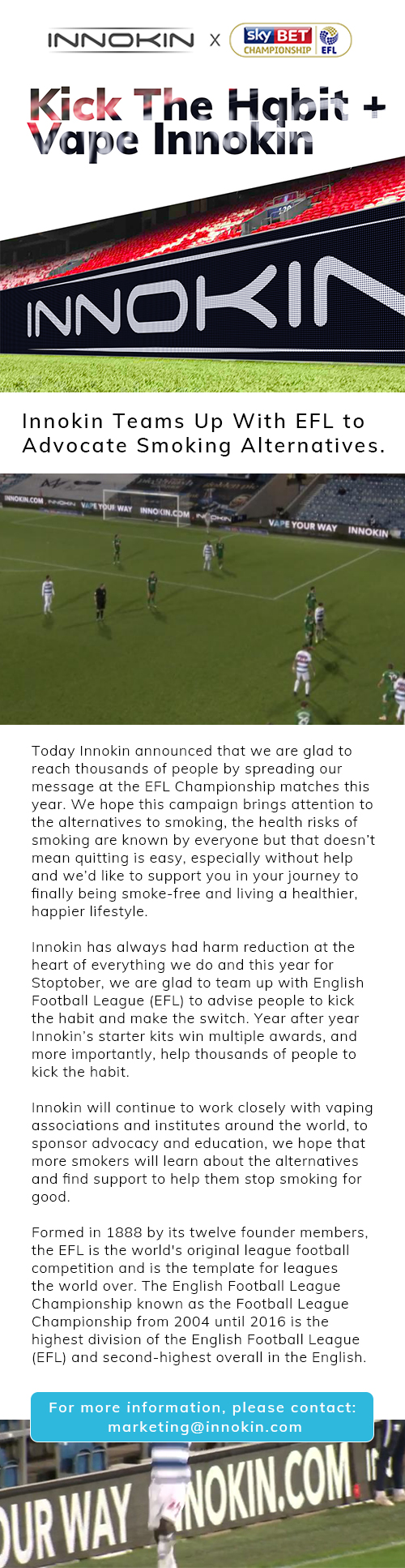

INNOKIN TEAMS UP WITH EFL TO ADVOCATE SMOKING ALTERNATIVES!

VAPING NEWS: BALTIMORE, MARYLAND [30% Vape Tax]

“Baltimore City leaders want to impose a 30% tax on the distribution of electronic smoking devices. City Council President and Democratic nominee Brandon Scott is spearheading the proposal, which was introduced during a routine city council meeting Monday. “The COVID-19 fiscal hit that we have take, we have to be thinking about how we can generate revenue as a city,” said Scott. This bill establishes a 30% tax on the process. It also repeals our local tobacco tax.“ Economist Anirban Basu, CEO of the Sage Policy Group estimates the move would generate millions annually for the city. The bill has been submitted to the Taxation, Finance and Economic Development Committee for review.”

ARTICLE LINK:

City leaders want to impose a 30% tax on the distribution of E-cigarettes

VAPING NEWS: MISSOULA, MONTANA [Flavor Ban]

“Missoula could become the state’s first city to ban the sale of all flavored tobacco products. City officials will take up the idea Wednesday morning. A coalition of Missoula physicians, parents, teachers and youth leaders is now asking the local city council to ban the sale of all flavored cigarellos, hookah, smokeless tobacco and e-cigarette products. That includes candy flavors, menthol and mint flavored tobacco products. The Montana Smoke Free Association, a trade group of about 15 vape shops issued a statement to MTPR Tuesday saying, “Montana Smoke Free Association can’t understand why Missoula County continues to push this agenda when the Legislature has already spoken.” The Missoula City Council’s Public Safety and Health Committee will discuss the proposal Wednesday morning. The full council is scheduled to take final action Monday, October 26.”

ARTICLE LINK:

Missoula Considers Ban On Flavored Tobacco Products And E-Cigarettes

VAPING NEWS: OREGON [65% Wholesale Vape Tax]

“A measure on the November ballot would create Oregon’s first tax on electronic nicotine products and dramatically raise taxes on cigarettes. Opponents of the tax have mounted almost no campaign, raising just $7,000 and inserting two arguments against it in the state voter’s pamphlet, compared to 49 yes arguments from proponents. If voters approve the measure, the state would tax all nicotine vape products, including nicotine-containing liquids and the devices people use to vaporize them, at 65% of a product’s wholesale price. The tax would not apply to marijuana-based products. Taxing vaping products would increase prices for buyers, which would make it less affordable, could help curb what health officials have said is an ever-growing epidemic. The only political action committee campaigning against the proposal, No On 108, has raised $7,000 from four vape shops, one of them in Medford, one in Roseburg and two in Portland.”

ARTICLE LINK:

Oregon Measure 108 would ratchet up cigarette taxes and create new tax on vape products

VAPING NEWS: U.S. ELECTION [Affecting Vape Products & Tobacco]

“The U.S. election will likely be a net negative for tobacco companies with exposure to the U.S. market regardless of the outcome, according to Goldman Sachs. The investment bank recently took an in-depth look at the key tobacco policy issues potentially at stake, including greater excise taxes, flavor bans, a federal nicotine cap on cigarettes and possibly a push for raising the minimum tobacco purchasing age to 25. Goldman Sachs says the highest likelihood is for greater excise tax increases, regardless of the election outcome, given the severity of government budget shortfalls in the wake of Covid-19.”

BILL TARLING — Reminder that the higher tobacco taxes don’t actually affect tobacco companies and cigarette sales as much as is usually claimed; since the Tobacco Companies usually just pass on that tax to to the consumer end (and may even additionally increase the retail price to hide the higher profit charge in with the tax increase)

ARTICLE LINK:

Store

Store